When we think of point-based travel, it’s easy to think of brands like American Express or US-heavy card providers like Capital One or Chase. Here in the UK, there aren’t a ton of reward cards due to a lack of fees, which the banks can then leverage into rewards.

However, Yonder has come out as one of the only UK-centric credit (and now debit) cards to offer perks and rewards based on everyday spending. That being said, the earning mechanisms and perks work a little differently from other bigger cards.

I’ve been using my credit card for close to a year, so here’s my honest review of Yonder. For context, I also have a Virgin Atlantic Flying Club Credit Card, which has reward points for Virgin Atlantic and its partners, so this is where most of my comparisons come from.

Disclosure: I have been gifted a membership for work purposes, but this review is not part of any deal.

If you’re interested, use my referral link to sign up for Yonder and you’ll get £10 off your first purchase, up to three months free, and up to 10,000 bonus points.

The Memberships

First things first, Yonder offers two memberships for credit cards: free and fee-paying. This is the same as most reward cards, and of course, if you opt for the premium membership, you get better perks.

The free card gives you:

- One point per £1 spent

- £10 back on your first spend

- No charges on overseas spending

- A welcome bonus of 1,000 points if you spend £1,000 in the first 30 days

The full Yonder card gives you:

- Five points per £1 spent

- £10 back on your first spend

- No charges on overseas spending

- A welcome bonus of 10,000 points if you spend £1,000 in the first 30 days

- First month free

- Worldwide travel insurance

- Use points on any flights

They’ve also launched debit cards using the same free and premium options, except the Full Debit Card only gets four points per £1 spent.

The membership cost for the full credit or debit card is £15 per month, with the first month free. You can also cancel anytime, so you’re not locked in. That works out to £180 per year, which is competitive, if not cheap, for most fee-paying reward credit cards. If you want to save, you can pay £160 upfront for the whole year.

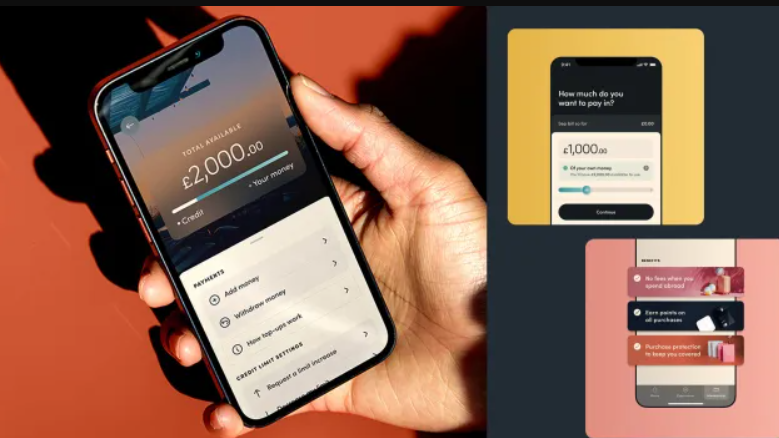

The App

The beating heart of Yonder is the app. It’s where you can find all the experiences, see your balance, and find your card details, as it doesn’t automatically come with a physical card. On the whole, it’s easy to navigate, and you can switch between regions or see online experiences that work from anywhere.

I love the map function for the experiences. If I’m heading to a new city where Yonder has perk partners, I can see what’s nearby without having to open Google Maps separately and cross-reference.

You can also get push notifications for transactions, prompts, and autopay for monthly payments, and you get an email each month with the new vendors and perks coming to the platform.

Locations for Perks

So, one of the downsides of Yonder is that they don’t have a huge number of locations for perks yet. At the time of writing, the cities with specific experiences and local perks are:

- London

- Birmingham

- Bristol/Bath

- Edinburgh

- Manchester

As the app and Yonder as a whole get bigger, they’ll add more locations. This is already more places than there were back in February when I started using them. I’m based in Liverpool, so there aren’t local ones specifically here, but I’ve used local perks in Manchester and London, and probably will when I’m in Edinburgh next month.

There are also online or non-geographical perks on the site. These include flights, lounge access, fitness, holiday accommodations, food and drink, jewellery and accessories, and more. So, even if you’re not close to one of the Yonder areas, you can still earn and redeem perks.

Top Perks

Probably Yonder’s headline perk is their claim that you can redeem points for ANY flight. It’s an incredible claim, considering this includes budget airlines like Ryanair and Easyjet. The caveat is that you can only redeem up to £200 worth of points, and the redemption value is lower for this option than many of the other experiences, like meals or hotels.

Other great travel-related perks include Lounge Passes, Yonder Hotels, Hostelworld, Unyoked, Trainline, and more. They also have extra partnerships with Qatar Airways and Cathay Pacific to give slightly better redemption offers.

Earning and Spending Perks

I’ve mentioned a few perks, such as the flights, hotels, and restaurants, but you can earn or spend at pretty much all of the vendors on the app. When you go to pay with your Yonder card, if it’s a partner, it’ll bring up a slider, asking if you want to earn points or spend them. You can also opt for partial pay.

This is cool because sometimes you don’t know if someone is a partner. For example, I bought breakfast from Pasta Evangelists in Manchester Airport and earned bonus points. Pasta Evangelists are listed for London or online, so I wouldn’t have gotten the points if I’d needed to manually tap into individual vendors.

Spending works the same way. You usually get three price redemption options (£50, £100, £200, for instance) with accompanying points, to give you an idea of how many points you’re going to need. For larger rewards, like Yonder Flights, it’s a maximum of £200-worth of points. However, for restaurants and bars, you can foot the whole bill easily and pay the exact cost in points.

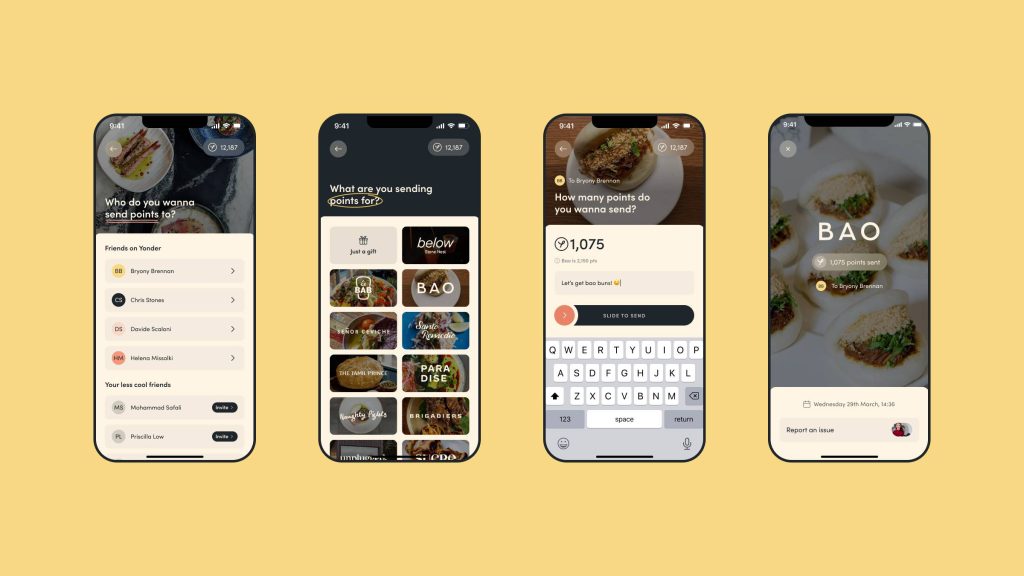

If you’re feeling generous, you can also gift points. This is great for group spending, or if you know your friend is working towards a particular spending goal.

Paying Off The Card

Paying off your balance is really simple in the app. You can set it to pay off automatically, or you can pay your balance (or part of it) using a click-through portal to dozens of UK banking apps. You don’t need to link one bank, so if you move money around or pay for things out of various accounts, this is handy.

When you open the app, it clearly says in the top corner how much your balance is, and when you click in, it tells you exactly when the next payment is due. Really simple, and not a lot else to be said here.

Customer Service

I’ve only interacted with customer service once, when one of my perk points didn’t go through. This was because it was a new perk, and I think the system hadn’t caught up. I did the chat within the app, and it got sorted quickly, with plenty of information and walkthroughs. The correct points were credited straight away, and it was all rather civilised.

Using Yonder Overseas

I’ve used Yonder across Europe and in Japan this year with no issues. It works the same as any other card through Google Wallet or Apple Pay. It immediately recognises when you’re overseas, charges no transaction fees, and gives you the rate of the day. When you return to the UK, it also tells you how much you’ve saved in fees with Yonder versus other providers, which is a cool touch.

Summary and Honest Review of Yonder

All in all, I really like my Yonder card. I enjoy that it’s not directly tied to a certain airline or hotel chain; however, that means the redemption values can be a little all over the place. I also like that there are a lot of sustainable brands and independent businesses on their perks and experiences lists, rather than just all chains. Of course, I’d love it if they actually had Liverpool on their app for dining and drinks.

At the moment, I’m slowly building points because I don’t live in one of the designated regions. However, I can see how you’d build quickly if your local coffee shop was on here or your favourite pub. Overall, it’s a great, user-friendly introduction to reward travel in the UK, and I’d recommend it, especially if you live in one of the listed regions.

If you’re interested, use my referral link to sign up for Yonder and you’ll get £10 off your first purchase, up to three months free, and up to 10,000 bonus points.

Great review! I’ve always been curious about Yonder. Your insights on the food are making me want to visit soon.